Ostrum: Die Fed beendet den Bilanzabbau

Die US-Notenbank Fed wird in dieser Woche wohl das Ende ihres Bilanzabbaus ankündigen. Der billigere Dollar nutzte unterdessen einer ganzen Reihe riskanter Assets. Und der Druck der Notenbank hat tatsächlich zu niedrigerer Volatilität geführt.

20.03.2019 | 10:21 Uhr

The main equity indices were up about 2% last week. Europe gained 13% so far in 2019. Shanghai posted even larger returns with a 24% gain year to date. Corporate credit markets have recouped earlier underperformance against sovereign bonds. Euro IG bond spreads narrowed 8bp last week to 123bp. Meanwhile high yield spreads shrank by as much as 19bp. Financials’ bonds also erased earlier doubts about ECB easing measures as bank stocks bounced by 4.4% from a week ago. Emerging debt is supported by dollar depreciation and higher commodity prices. USD-denominated spreads dipped below the 350bp mark. The rise in oil prices also benefitted inflation-linked bonds. Breakeven inflation at 10-year maturities are back near 2%.

Dollar weakness reflects investor positioning before the FOMC. The euro-dollar bounced by about 1% to $1.135. In turn, the BoJ’s accommodative policy prevents yen from strengthening. Sterling is an enigma. The British pound is trading above $1.325.

FOMC: the end of normalisation

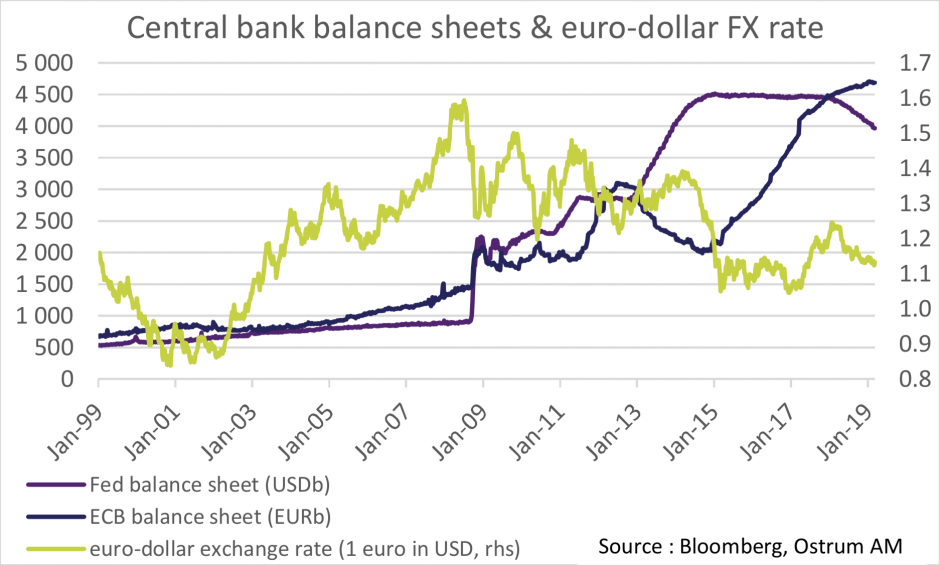

The Fed raised interest rates by a total of 225bp since December 2015. In parallel, the Fed gradually ceased to reinvest the proceeds from its portfolio of Treasury bonds and mortgage-backed securities built since the 2008 crisis. The Fed seems to consider that the size of its asset holdings is close to the optimal level to manage cyclical and financial risks. Jerome Powell indeed recently suggested a target size of 16-17% of US nominal GDP. This would correspond to asset holdings of $3.450T, or just about 500b under current balance sheet size. Assuming an unchanged pace of reduction ($50b per month), the objective could be reached by year-end 2019. The end of monetary normalisation spells a prolonged status quo on interest rates if the Federal Reserve wishes to avoid inverting the yield curve, which would hit bank margins.

On the economic front, a soft patch in growth in 1q19 argues for a pause. Activity may have expanded modestly due to weaker consumer demand for durable goods and a negative contribution from trade. Delays in tax refunds, protectionism and government shutdown took a toll on activity through January- February. Hence 1 ̈%qa growth appears likely in the three months to March. Elevated confidence surveys, strong corporate investment spending and continued employment gains suggest a pickup in the coming months but the Fed is unlikely to take a chance and potentially derail the market rally with a more restrictive tone.

The Fed blows up valuation

In this context, a long duration stance is recommended in US bond portfolios. Steepening exposure is maintained in the 10s30s segment. The corollary of the end of normalisation is a lower dollar which is a boon for a broad range of risky assets. Breakeven inflation rates with 10-year maturities have increased to just under 2% despite February CPI coming in below expectations at 1.5%y. residual impact from lower energy prices in 4q18 is still visible in utilities prices (gas, electricity) may fade in the coming months. Emerging debt greatly benefits from a lower dollar. Emerging spreads now stands under the 350bp threshold. All emerging sovereign issuers enjoy more favourable borrowing terms.

US equity markets shrug off declining earnings in the first quarter across all sectors but telecommunication services. Markets seem to be pricing in a swift solution to the current China-US trade conflict. However, there has been little improvement so far. Stocks most exposed to foreign markets keep outperforming stocks with a larger domestic revenue exposure. Valuations metrics have risen again, which may reflect excess optimism. Double-digit returns and low volatility may argue for portfolio hedging. Price-earnings ratios based on 2019 EPS hover about 16.5x. Furthermore, implied volatility skew has collapsed. Such market backdrop is reminiscent of positioning ahead of the January 2018 volatility spike and price correction.

Euro credit strongly outperforms

In the euro area, the ECB sparked buying of peripheral sovereign debt by announcing a new round of TLTRO- III. In parallel, Portugal’s rating upgrade to BBBu by S&P reflects improving economic backdrop and sound public finances. Portugal spreads with 10-year maturities broke below the 120bp mark. More surprisingly, Moody’s left Italy’s sovereign rating outlook unchanged, which also spurred buying of BTPs (235bp). The yield on Bunds (0.08%) keeps pointing south, which contributes to the broad flattening pressure (2s10s notably).

The most notable development in euro fixed income markets pertains to corporate credit. Investment flows into credit funds have accelerated in the past few weeks. Hence, cash credit has erased the bulk of its recent underperformance vs. sovereign bonds and CDS indices. The average spread on euro IG bonds is 29bp narrower now than at the start of the year. Financials’ debt participated to the rally after some hesitation as markets digested new ECB policy measures. The rebound in Tier 1 is quite impressive indeed. Subordinated bet and Tier 1 are up about 5.6% year-to-date. High yield spreads also came in (-19bp) and now trade near 405bp over German risk-free rates following on from the sharp rally in iTraxx XO (-15bp to 270bp).

European equities continue heading higher after a strong start of year. So far in 2019, the main European equity gauges recorded surprising double-digit gains (+12-15%) in the context of an economic slowdown. Cheap valuations may have played a role in sparking a turnaround but it may be fair to say that political and cyclical risks are being ignored. European equities are trading above 12x 2019 earnings. As is the case in the US, implied volatility skew to the upside indicates bullish sentiment, which would turn out to be overly optimistic.

Lastly, the Brexit deal agreed with the other 27 EU member states will be put to vote in the UK Parliament for the third time this year. If approved, Brexit will take place on June 30th. In contrast, another rejection of the deal would reopen Pandora’s box with possible new elections, new referendum ...

Diesen Beitrag teilen: