Morgan Stanley IM: You Are Not Doing ESG Investing

The frequent appearance of ESG in everyday conversation is a welcome development. However, it is very important to clarify what ESG is (and what it isn’t) and employ this frequently used term in its proper context.

22.04.2022 | 07:10 Uhr

Here you can find the complete article

ESG, which is shorthand for Environmental, Social and Governance factors, is having a moment. While the concept has been around for a while, references to “ESG investing, ESG funds, ESG strategies” in the media and by data providers seem to have spiked in recent months.

The term “ESG investing” is often used as a stand-in for sustainability or impact investing. It is not uncommon to hear comments along the lines of “investing in renewable energy is a key part of our ESG strategy”. In short, people assume ESG investing requires the pursuit of positive impact or doing good—for the planet or people in need. This is not the case.

In our view, ESG is not about doing good, nor is it an investment strategy in itself. ESG is simply a framework that can and, we believe, should be applied to all investment diligence processes. ESG diligence aims to identify and mitigate economic, social and governance risks that could weaken or de-rail an investment. For example, a company with inadequate environmental controls may suffer damage to its revenues, profitability, reputation and valuation should an incident occur. Investors who do not follow a process that would enable them to identify this company’s environmental shortcomings before they decide to commit their capital are likely to suffer alongside it. One does not have to be a “do-gooder” to see how weak ESG can materially affect investment returns.

When thinking about ESG, most people focus more on the “E” component, likely because the dangers are more tangible and potentially catastrophic. BP’s Deepwater Horizon oil spill is a prominent example. However, in our view, social and governance risks are equally important. Social risks occur when communities are harmed in a way that is not environment related. Wonga, a pay-day lender in the UK, saw its path to a $20bn valuation wiped out when it was accused of predatory lending practices. On the governance side, the financial press is rife with stories of managerial misconduct, from fraudulent accounting to inadequate board oversight. Theranos, for example, went from a much hyped start-up to a scandalous mess, largely in part to insufficient governance procedures.

The good news is that most investment teams consider these risks when evaluating opportunities. However, they may not bucket them into discrete ESG categories or have a formal ESG investment policy or process in place. We believe that having a strong ESG umbrella to corral these risks under in a cohesive way is valuable. A robust ESG focus embedded in all stages of the investment process, from underwriting to execution and monitoring, is fast becoming the basic requirement for any serious investment organisation. In our view, simply using an “ESG overlay” or “ESG lens”, or “giving consideration to ESG factors”, will not cut it in a sophisticated world where the asset owners and stakeholders are deeply conscious of the risks they want to avoid.

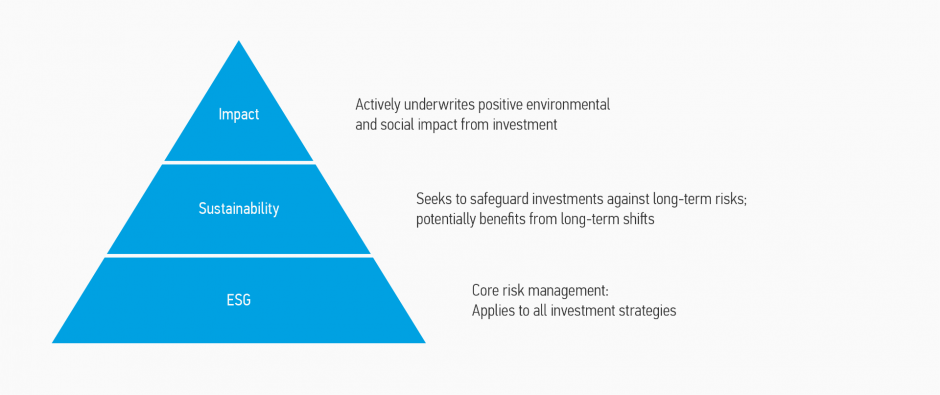

DISPLAY 1: Responsible Investment Prism

How does this translate into action? An ESG policy is not credible if it remains just a policy. For it to be meaningful, we believe all of the investment staff need to be trained on it and such training should be refreshed on a periodic basis. We believe the tone of solid ESG processes is set at the top of organisations, and, as such, a senior member of the investment team should own the ESG process. The trained investment team should then proactively discuss ESG risks during the investment process and not address them as an afterthought. The ultimate test is whether an otherwise attractive investment is rejected because the ESG risk cannot be mitigated.

It is also important to acknowledge that ESG is not a blunt instrument. We believe it is fine to vary the level of ESG intensity from deal to deal. An investment in chemical manufacturing will require greater consideration of environmental risks than one in the software sector. The sales practices of a business focused on the public sector may require a different level of scrutiny that those of a direct-to-consumer business.

This is an evolving phenomenon and we think teams should be open to grappling with contradictions and grey areas and using a feedback loop to refine their thinking about ESG.

It is also important to place ESG in its correct context along the continuum of responsible investing.

- ESG, as discussed, is about doing the right thing with the aim to safeguard against downside risk. It does not require a change in investment mandate such as divestment from certain sectors like extractive industries, nor does it require token efforts such as using low energy bulbs (a frequent example). ESG, in our opinion, is simply about making sure the risk of an investment failure is tightly controlled. While there may be some positive social or environmental impact from improving ESG standards, it is incidental to the investment strategy aims.

- Sustainable investing is about seeking to achieve long-term resilience of an investment. It can be either something inherent in any long-term investor’s process or it can be an explicit strategy. This could include looking at the environmental sustainability of the production process or the viability of the supply chain. It could also mean being aligned with market trends and consumer preferences. Examples include building back up data centres in areas less prone to flooding, switching from fossil-fuel based inputs to plant-based inputs and changing stock-keeping units to cater to the growing preference for organic products. It could also be about analysing an insurance company’s liabilities arising from coastal properties or a services company adapting robotics to deal with labour shortages as the population ages. A lot of sustainability strategies will generate clear positive impact but it is not the objective of the investment strategy.

- Impact investing, on the other hand, is very much a distinct strategy which seeks explicitly to do good—reduce CO2 emissions, save water, improve access of education and housing to deprived communities—while making sure the investment also seeks to generate compelling returns. Impact may have elements of good ESG and sustainable practices, but it is not always certain. An impact investing team, like any other investing team, needs to incorporate proper diligence procedures to seek to ensure that ESG risks are squared away. Investing in a solar farm or an affordable housing project does not automatically allay pollution risk or weak governance.

In our opinion, embedding ESG in the investment process is crucial for any investment strategy no matter where they are focused on the investment spectrum.

There is no such thing as ESG investing, but there is such a thing as employing an ESG framework to evaluate the merits and risks of an investment. We believe that, over time, as more and more teams put this structure in place, this will be known simply as “investing.” Nothing more, nothing less.

Diesen Beitrag teilen: