NN IP: Trade truce is not a peace pact

The first big event of December – the G20 Buenos Aires summit – is behind us. It resulted in a 90-day postponement of the introduction of new trade tariffs and some concessions by China; in the meantime, the trade talks continue.

06.12.2018 | 15:04 Uhr

This outcome is buying time. Of course, this is a truce, not a peace agreement, and tariffs can still be introduced at a later stage instead of 1 January. The initial market reaction was positive but faded afterwards as uncertainties remain.

There is a sense of positivity in anticipation of the OPEC+ meeting on 6 December. Russia and Saudi Arabia appear willing to cut production, and the Canadian province of Alberta has already ordered a production cut. Together, these cuts would remove up to 1.5 million barrels/day, which is more than the 1 million the market was hoping for. Qatar’s decision to leave the cartel is a less positive development however. The country represents approximately 2% of OPEC output.consectetuer adipiscing elit. Ut commodo pretium nisl. Integer sit amet lectus. Nam suscipit magna nec nunc. Maecenas eros ipsum, malesuada at, malesuada a, ultricies dignissim, justo. Mauris gravida dui eget elit.

The third event this month is the UK parliamentary vote on the Brexit

deal on 12 December. The outcome is difficult to predict. The government

does not have a majority and even the governing Conservative party is

divided. However, market consensus is moving towards approval of the

deal, perhaps not on the first vote but more likely on the second and

after some amendments. The impact on equity markets is not

straightforward. The UK market is significantly influenced by global

factors like commodity prices, Asia and of course the trend whereby a

strengthening GBP is negative for the FTSE 100, which consists primarily

of large international companies. Therefore, parliamentary approval may

initially lead to a higher sterling and hence a weaker UK equity

market, perhaps not in absolute terms but relative to global or Eurozone

equities. This is not to say that a no-deal outcome would be positive.

Indeed, this would appear to be a lose-lose situation for UK equities.

We upgrade emerging markets and downgrade Japan

We made two regional changes this week. First, we upgraded emerging markets from neutral to a small overweight. This was motivated by several elements. These include the dovish shift in Fed talk, with Powell indicating that rates are close to neutral. This removes one of the big headwinds for the region. In addition, and as a consequence of the dovish shift in rate expectations, the USD may stabilize or even depreciate slightly. This would remove the second major headwind for the region. And the truce in the trade war between the US and China is another positive development, at least over the next three months. The fundamental issues on trade and technology transfers are still there and are far from resolved.

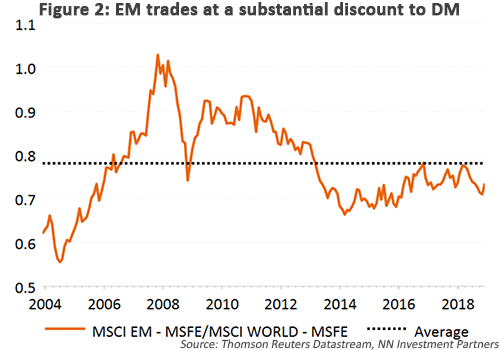

These elements come in addition to the longer-term elements. Emerging markets are still the biggest underweight region in institutional portfolios. At the same time, flows have turned positive. And finally, the valuation discount of EM versus DM has grown to almost 30% and is above the long-term average.

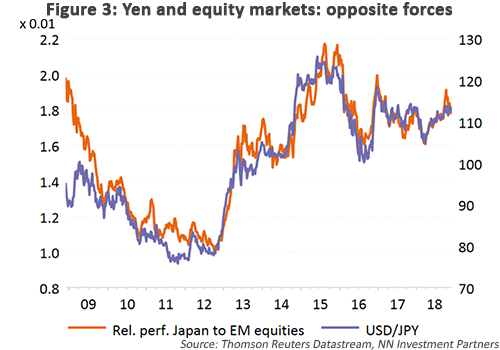

The second change we made was to move Japan from neutral to a small underweight. A weaker USD is generally perceived as negative for Japan. In addition, the expected earnings growth for 2019 is less than 4%, far below the global average of around 8%.

Diesen Beitrag teilen: